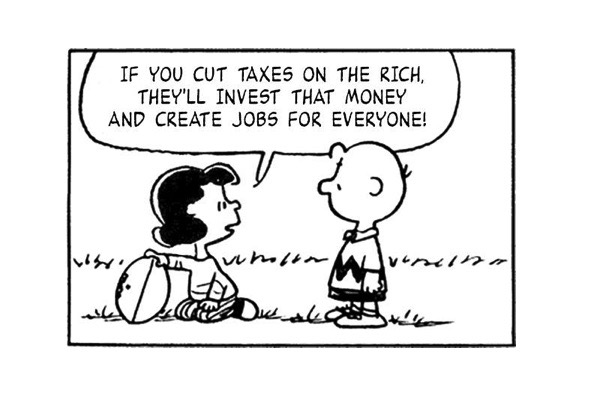

Trickle-down is a scam.

Trickle-down not only doesn’t work, it obviously couldn’t. The first hint is in the name: “Trickle-Down.” Not “Rain Down,” “Shower Down,” “Torrent Down,” or “Flood Down,” but just a trickle, at best. The idea that workers get almost nothing is right there in the name. You’d think that people would have caught on to this sooner. It would be like an employer offering their workers a raise and calling it “Crumbs off the Table.”

From there it gets worse. The idea of the theory is to jump-start the economy by giving money to rich people. There are several rather unmistakable reasons why this wouldn’t help the economy.

First, rich people are, not to put too fine a point on it, rich. They don’t need money to invest, they already have it. Thus the “rich” part of it. They already get generous tax breaks on successful investments in the form of capital gains taxes; that gives them more money already. And if all their wealth is tied up in other ventures, there is a long line of banks that are usually willing to issue them big loans in order to help them invest. If they come to a bank and say, “Here’s a great opportunity to create a business with a promising future,” loans are almost inevitable.

Next, giving rich people more money via tax breaks does not guarantee that they will invest it in a way that creates more jobs. When a rich person gets more money, their natural reaction is to say, “How can I make the most money with this money?”

This is where Trickle-Down is most clearly absurd as a solution to a depressed economy: if no one is buying anything, then the last thing a rich person will do is invest in building factories to sell things to people who aren’t buying anything. Instead, they will either hoard the cash if nothing is paying off, or else maybe invest in derivatives, which usually create few or no jobs at all.

For example, if a rich person invests money in stocks, that mostly just represents value moving from one person to another. It does not create wealth, nor does it spur jobs. At the very best, if enough rich people buy stock in a company, the stock price will go up—which may improve the image of the company, and could help it buy more acquisitions, but not really to create a large number of new jobs. By the time you get to any job increases, the percent of what was spent on the tax break for rich people is so diluted that the benefit in jobs is lost in the white noise of market fluctuations.

Next, we have the basic function of capitalism: the idea that people will create jobs and wealth in pursuit of wealth made by commerce. The critical point here is that rich people getting money is the inducement for creating jobs. You invest, build, hire, produce, sell, and profit. Profit is the end of the process. That’s the whole point.

Giving rich people money should be the end reward for that process, not the start of it. If you start by giving rich people more money, there is, if anything, less incentive to work harder for it. It’s like giving the horse the carrot at the start of the ride, not the end. Or, more to the point, it’s like putting gasoline in your tailpipe. It creates a nice flash, but gets you nowhere.

So, What Creates Jobs?

It’s important to realize that companies, by their nature, do not create jobs. They avoid creating jobs. As Nick Hanauer put it, corporations are not job creators, they are job destroyers. Employing people is a cost. To maximize profits, businesses need to minimize costs. And since payroll is normally one of the biggest expenses any company has, they do everything they can do minimize it. That means paying less in salary and benefits (and destroying unions which would demand such things), making workers do more work for the same pay (businesses call this “productivity”), replacing workers with automated processes, and firing workers whenever possible.

Businesses don’t hire workers because they are charitable and like helping the working class. They only hire workers when it is impossible to profit without workers—and then fire the workers as soon as their jobs fail to make enough money for the company.

In short, businesses don’t want to create jobs; they only do it when absolutely necessary, and destroy the jobs as soon as it is profitable for them.

Capitalists will say that greed is good, as a motivator to make people invest. The problem is, greed has no limits. Corporations, by their nature, endlessly look for ways to increase the bottom line. Pay workers less, charge customers more, skimp on safety and corporate responsibility—exactly the opposite of what free-market capitalists claim will happen in an unregulated system.

There is a dire problem here. Businesses make money in the first place because the general population has enough wealth to buy the things offered for sale. If people don’t have enough money to buy things, then sales diminish. The more you underpay workers and lay them off, the less wealth there is to buy the things businesses are selling. Capitalism pushes wealth upwards, robbing the poor to pay the rich. If too much wealth accumulates at the top, the business cycle dies.

It is very much like a game of Monopoly: at the end, one person gets all the money, and then the game ends. We play that game, but we fail to project forward to think about what happens to the people who lose, and how the economy functions after that.

So we see that if money fails to cycle back to the workers, the system fails and collapses. It becomes clear, then, that the problem is not that there is too little wealth at the top, the problem is that there is too much.

What you really want in the end is more commerce and more jobs, right? Supply-siders claim that the best place to stimulate that system is at the top. The problem is, that’s the furthest point from where the stimulus is needed. Instead, wealthy people will divert most of that wealth away from commerce and jobs, as explained above. That means that a small percent—just a trickle—goes from wealthy people to investment in commerce—where a percent of that wealth goes back up to the wealthy again—and thus a smaller percentage to jobs, and an even smaller percentage back into commerce.

Adding more money to the already large amount owned by the wealthy mostly just helps the wealthy, and by the time it gets to where it is needed, it’s too small an amount to do much good.

Instead, the stimulus needs to be plugged into the part of the cycle where it will have the biggest impact: people buying things. That is the true beginning of the cycle. Consumers have money and want to buy things, so businesses respond by creating jobs to produce the things people want.

Consumers with money drive economic growth the most directly and effectively.

If you give that tax cut to the working poor and middle class, they will inject almost all of it directly into the economy, buying goods and services. They will be far less likely to hoard it or direct it into derivatives. Instead, it will be spent in a way that directly and most effectively spurs job growth, tax revenue growth, and yes—even the growth of profits for rich people, who will have to actually work to get that money, as capitalism supposedly intended. Where tax breaks for rich people will result in only a tiny percentage creating jobs and commerce, tax breaks for workers results in most of that amount creating commerce and jobs. Far, far more effective.

The cycle always works best when more money is in the hands of working people. We saw this In the 40s and 50s when the top marginal tax rate for wealthy people was 90%, and the working class, strongly supported by powerful unions, had a great deal of disposable income. But now? Now, we have already run out of wealth for consumers to spend, and the cycle is mostly supported by what is left: debt spending. Not a sustainable solution.

What is needed is what we did from 1936 onward: tax wealthy people more, and, with the help of unions, put as much money as possible into the hands of workers. That’s the equation that will work.

Direct spending that puts more money in the hands of people at the lower end of the scale has been found to be far more effective at stimulating the economy. Food stamps, unemployment benefits, spending on infrastructure, and other programs to help the working poor have great stimulative value.

Direct spending that puts more money in the hands of people at the lower end of the scale has been found to be far more effective at stimulating the economy. Food stamps, unemployment benefits, spending on infrastructure, and other programs to help the working poor have great stimulative value.

On the other hand, tax cuts for rich people and corporations are among the least stimulative actions you could take, and actually drain the economy.

It has been demonstrated again and again that the economy works by “profits-up,” not “trickle-down.”

If you want to create jobs, flood the lower and middle class with spending money. That’s where they money has the greatest positive impact. Trickle-down is like trying to eat well by giving a ravenous friend your dinner money and hoping that he brings you leftovers.

Arguments to the Contrary

Conservatives typically avoid arguing about how working class spending affects the economy because the answer is so obvious. Instead, they focus on the poor, starving rich people.

A popular argument is straight out of Ayn Rand: rich people are creators, they are the productive class. If you don’t give them tax cuts, and especially, if you dare to raise their taxes, they will decide that it just isn’t worth it, close up their businesses, putting workers out of a job, and the economy will fail.

This is presented as a serious idea, but once you consider it, it is so laughably absurd that it is amazing that anyone is actually trying to argue it.

One excellent example is Bill O’Reilly, who, on his show (in 2011, when it was still on), made this exact point. He used himself as an example. O’Reilly said that if Obama, who was president at the time, were to raise the marginal tax rate to 50%, O’Reilly would have seen that as too onerous, and would have quit his cushy, estimated $20 million-a-year job, laying off “scores” of workers. Why? Because O’Reilly having a take-home of $10 million instead of $12 million (if the top marginal rate were the real rate, which it is not) is just too little for him to sit on his ass all day and pontificate to crowds of adoring fans. What a hard life to lead. No, he would have rather fired dozens of people who depend on him rather than suffer with only $10 million a year, with a personal net worth of at least $50 million. Poor little rich man.

Not to mention the fact that business is a cutthroat environment absolutely brimming with people waiting in very long lines to compete. The moment one businessman closes up shop, a hundred more jump out to compete for the business left behind.

The conceit also assumes that the people controlling these companies are so uniquely talented that the next hundred would not be able to do nearly as good a job. Like, I suppose, Donald Trump, perhaps? No. While some have talents in marketing and management, these are not unique talents limited to the special few. There is more than enough talent out there.

In addition, the very idea that a businessman would close up shop with only fair profits instead of excessive profits is preposterous. People in business have to be able to weather the most severe storms, including intense competition, market downturns, and all the way up to bankruptcy and rebuilding. And yet the Randian theory suggests that all of these people are so weak and frail that a 10% tax hike would send them packing.

Any real business owner who shut down their business because of a tax hike would be mocked viciously as they were trampled by the stampede of other businesses clamoring to take their business under the higher tax rate. Profits are profits, you never turn one down.

Then there are the bogus statistics. Conservatives have two basic arguments why tax hikes on rich people won’t work. First, rich people don’t have enough money, and second, they pay too much in taxes already.

The first argument says that even if you taxed rich people at 100%, it would only produce enough revenue for running the government for a few months; there just isn’t enough money there to do the job.

The second argument is that rich people already have too high a burden. In this argument, they claim that the top 1% of income earners pay about 40 percent of all taxes into the federal government. So unfair! And let’s not mention that the top 1% own about 40% of the wealth, so a 40% rate is more than fair. No, let’s totally ignore that.

But wait. Those two claims by conservatives don’t add up. The average real tax rates (the actual percentage of earnings paid as taxes after all adjustments are made) for the top 1% is given as 25%. And if 25% of their income pays for 40% of all taxes collected, then 100% of their income should pay for 160% of all taxes. That would absolutely be more than enough to do the job for the whole year and then some.

The discrepancy between the two arguments proves that these people are playing fast and loose with the numbers; both arguments are full of lies.

Usually, individual conservatives don’t make both arguments; some make one, and some make the other. But few make both. Few, but not none. In 2011, Michele Bachmann shamelessly made both arguments in one three-week period. No one in the media called her out on it.

In fact, you should consider why rich people still work at all. I mean, if I had ten million dollars free and clear, I would fucking retire. I would buy a nice house and live well off my savings.

So, why do rich people keep working? I can see six reasons:

- They like money. there are variations on this, but it boils down to greed. No amount of money is enough. Give me more, more, more. It’s an obsession.

- They want to win. They want to be the best, or at least amongst the best. They want to have the biggest pile of toys, the most corporations, the biggest mansions, the greatest private jets and yachts. It’s a competition.

- They have a monetary goal. Once they hit certain figure or status, they consider their goals achieved, and then stop working—but will continue working until that happens.

- They have a non-monetary goal. Maybe they believe in the work they are doing, and money is just a means to that end. Maybe they hit their monetary goal way back when, but keep at it because they believe they can accomplish something that they consider important.

- They love their work. They love doing what they are doing, they are artists or professionals who believe in what they do, and love doing it more than anything else.

- Their identity is based upon working. They need to work, they have to do what they do; they would not know what to do with themselves if they ever stopped.

So, how would these people respond to higher tax rates?

- People who like money would still like money. They would actually work harder for it.

- People who want to win would still want to win, even if the prize were smaller.

- People who have a monetary goal would have to work longer and/or harder to achieve that goal. Yes, they would then quit, but they would have quit sooner if their taxes had been lower.

- People with non-monetary goals wouldn’t particularly notice, unless somehow the increased taxes made it impossible to reach their goals—and considering how exceptions are always made to encourage more business, it is safe to assume they’d be covered.

- People who love their work regardless of the money would still love their work and keep doing it.

- People whose identity is based on working would still work.

As you can see, with all of these groups, raising taxes would not stop any of them—and with some, it would actually spur them to work harder and longer.

And then there is one more reason that we knowing high taxes on rich people would work: because we did it and it worked.

At Davos in 2019, Michael Dell scoffed at the idea of a top marginal tax rate of 70%, retorting, “Name a country where that’s worked!”

Well, The United States of America, Mike. For 45 years, from 1936 to 1981. The fact is, the higher we taxed rich people, the better the economy was. High tax rates helped us win WWII, and helped create a supercharged middle class that created an economy that even conservatives refer to as a “golden era.” Clearly, we did not tax rich people out of existence.

As a result, we know for a fact that a top marginal rate of 70% will, in fact, work extremely well.

Oh, you know what else we had before the top tax rate was lowered below 70%?

We had unions. That is, a mechanism to fight for better pay and benefits for the working class, thus enabling more wealth in the hands of people who actually power the economy.

The point, I hope, has by now been made abundantly clear. Our economy is better off when we tax the rich more and the working class less.