Are You Better Off Now Than You Were Two Years Ago?

It’s a fair question. For some, the answer may be “no.” But for a lot more, the answer will be “yes.” For me, I cashed in some Apple stock which got badly beaten down by the Bush housing crisis; this week, I sold it for almost four times what it was worth when Bush left office. If nothing else, it speaks to the health of the stock market, which right-wingers initially tried to blame Obama for just a month or two after he took office (they don’t any more, you will note).

But let’s take a look at a more general picture. Three very meaningful questions asked in a post from DailyKos:

1. What was the average monthly private sector job growth in 2008, the final year of the Bush presidency, and what has it been so far in 2010?

2. What was the Federal deficit for the last fiscal year of the Bush presidency, and what was it for the first full fiscal year of the Obama presidency?

3. What was the stock market at on the last day of the Bush presidency? What is it at today?

There is a fourth question (about Boehner, the next Speaker should Republicans win the House, campaigning with a Nazi re-enactor), but I see it as relatively inconsequential, and meaningless to most voters, so let’s go with those three. The answers:

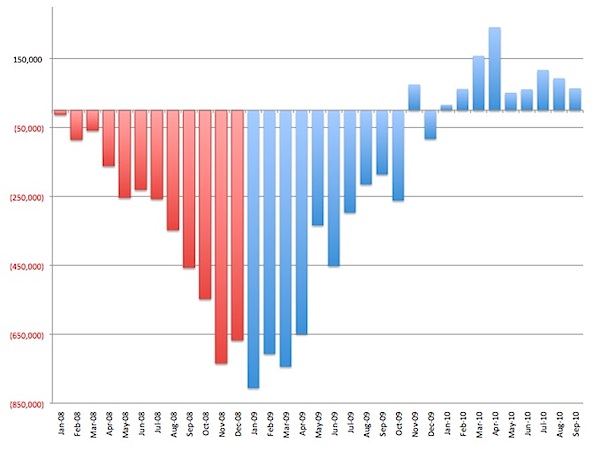

1. In 2008, we lost an average of 317,250 private sector jobs per month. In 2010, we have gained an average of 95,888 private sector jobs per month. (Source) That’s a difference of nearly five million jobs between Bush’s last year in office and President Obama’s second year.

2. In FY2009, which began on September 1, 2008 and represents the Bush Administration’s final budget, the budget deficit was $1.416 trillion. In FY2010, the first budget of the Obama Administration, the budget deficit was $1.291 trillion, a decline of $125 billion. (Source) Yes, that means President Obama has cut the deficit — there’s a long way to go, but we’re in better shape now than we were under Bush and the GOP.

3. On Bush’s final day in office, the Dow, NASDAQ, and S&P 500 closed at 7,949, 1,440, and 805, respectively. Today, as of 10:15AM Pacific, they are at 11,108, 2,512, and 1,183. That means since President Obama took office, the Dow, NASDAQ, and S&P 500 have increased 40%, 74%, and 47%, respectively.

While the source of the questions and answers is biased, the facts are not. Once again, under Obama and the Democrats, job numbers have improved markedly, the deficit, while unwieldily, is not Obama’s doing, and business is much better than it was. Compared to two years ago, things are much, much better.

The question any self-interested voter should ask is, do I want to go with the people who made things worse, or do I want to go with the team that made things better?

You can focus on side details as much as you want, try to ignore the mountain for the pebbles, but one thing is inescapable: Obama and the Democrats performed well on the economy–much better than the Republicans, who dropped us into the cesspool Obama and the Dems have subsequently been blamed for.

For those seeking to confirm the job stats, go ahead and visit the Bureau of Labor Statistics site, and download the data tables showing All Employees, Total private; the data you get will show you private sector job standings by month. Use Excel to calculate the month-to-month changes, then (a) add the gains & losses in 2008 and in 2010 (to September), and then (b) chart it out.

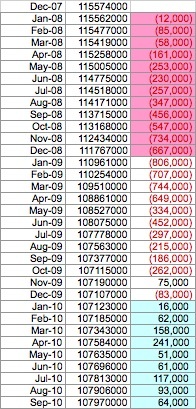

The raw table:

Here’s the table after transposing, selecting, and calculations:

And the chart:

Oh, and from a Feb. 2009 NYTimes article about private sector jobs over the past 35 years:

One of the weakest sectors was manufacturing. The number of such jobs peaked in 1979, when Jimmy Carter was president, and fell in every administration since, with the exception of a small gain in the Clinton years. The decline in the current administration, at a rate of 3.1 percent a year, is the steepest yet seen.

Carter and Clinton were the best at adding jobs; Reagan and both bushes the worst. How about that. If Obama’s total numbers are low, it’s due to the hole Bush left for him to climb out of.

While I of course agree that the Republicans have zero policy cred wrt solving anything and will likely make things a lot worse once they regain control of the House next year, I do think your analysis is over-personalizing the dynamics.

For one, the economy needs to add 120,000 or so jobs each month just to keep up with population growth. This has been one skeevy recovery.

As for manufacturing jobs, here’s the raw graph:

http://research.stlouisfed.org/fred2/series/MANEMP/10

but here’s a more interesting graph:

http://imgur.com/cyTTy.png

showing the % of the private workforce engaged in manufacturing. This is simply a trend without end — it’s clearly relentless.

Chinese factory workers make in a month what we make in a day. Why shouldn’t every mfg job go there?

The facts may not be biased, but they are selective. Only massive deficit spending is keeping the present economy together. This should be very familiar to you, having been in Japan since the late 90s.

The external national debt has grown by $1.5T in the past 12 months. That is THIRTY MILLION $50k/yr jobs! One heckuva stimulus!

Of course, the reason we’ve had to dump so much borrowed and printed money into the economy is to prevent deflationary credit shock and the ensuing cross-default meltdown.

This is the true story of the economy:

http://research.stlouisfed.org/fred2/series/CMDEBT

the PTB let things get really out of hand 2002-2006, as they apparently decided it was OK to let consumer debt accumulation drive the larger economy. By 2006 households were adding over $1T of new debt each year, but now households are defaulting on $500B/yr of debt. +$1.0T to -0.5T, that’s a $1.5T turnaround in the flows, and exactly what the deficit spending is.

This is no accident. The economic situation is critical and we are far, far from being out of the woods on this.

We’ve severely overcommitted to housing sector investments and there’s still many shoes to drop here. Adding to the headwinds will be supply shocks in oil production and China’s strengthening yuan being able to buy more oil, essentially allowing them to buy a better seat at the oil table and putting demand-side pressures on oil supply right as we find ourselves in Peak Oil city.

I don’t know how any of this is going to turn out. I think the House is already lost and that’s just going to totally screw us since this is no time for government to “grid locked” by the Party of No.

http://www.electoral-vote.com/ is saying that even the worst case of the Senate the Dems will still retain control, 50 seats. TP really shot themselves in the foot putting O’Donnell in DE, but that is one bloody map regardless.

Oh, don’t get me wrong–I am not trying to say that things are spiffy now. What I am saying is that an outright, drop-off-the-cliff economic disaster was halted and we recovered a great deal in a relatively short time. I mean, look at Bush’s “recovery” and you find that you have to read a hell of a lot in to the numbers and essentially deny that time and natural economic rhythms had no play in order to give Bush credit. Compare that to Obama’s charts and you can see that it is obvious he had a significant effect.

It is not his fault that the hole we were in was so deep that a small miracle of a comeback was not nearly enough to get us on good footing. I agree with what you’re saying, but stick to my main thesis that Obama and the Dems did us a whole bunch better than Bush & the Reps did–especially considering that they had to drag a Republican Party along with them all the way, one which was filibustering and smearing and attacking more than any in peacetime history.

and we recovered a great deal in a relatively short time

That’s where your red/blue chart above is misleading you. Even if we did nothing in 2009 the economy wouldn’t collapse to zero, so the ending of the job losses in 2010 was to be expected.

This is the true picture:

http://calculatedriskimages.blogspot.com/2010/10/job-losses-and-recessions-aligned-at.html

The core problem is that everything has become so entirely politicized. Arguments have been reduced to people bound to rooting for their own teams. Nobody knows the facts or understands the dynamics. What we have now is just wall to wall bullshit.

Much like the move to invade Iraq in 2002-2003, neither side covered themselves in glory in 2003-2006 wrt the asset bubble. Republicans were the active participants with the Democrats being the passive participants.

http://www.amazon.com/Bush-Boom-Misunderestimated-President-Economy/dp/1594670870

Only Krugman has the perspective and public position to be the voice of honesty if not reason:

http://www.nytimes.com/2010/10/25/opinion/25krugman.html

http://www.nytimes.com/2010/10/29/opinion/29krugman.html

Just like 1994, the Democrats have done f-ed up their political game, and we are a stupid people about to do a stupid thing. The bullshit is too much. Reality does not obtain.