Debunking the Right-Wing Economic Talk-Down

The jobs report is out, and it’s great news: solid growth for the third straight month in a row. Krugman:

OK, definitely a better jobs report than we have become used to. And terrific news for Obama; another six months of news like this and he’ll be in very good shape for reelection.

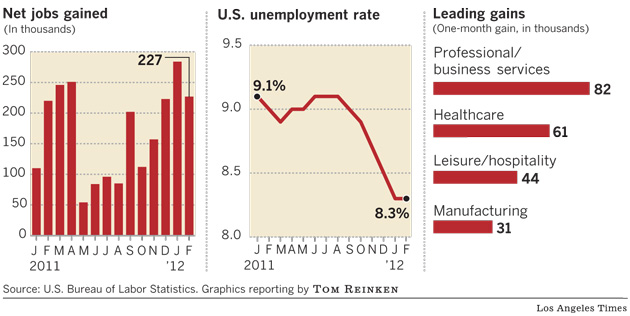

Krugman goes on to warn that we’ll need a lot more of this–31 months at this level or better to get to “full employment”–but still, the current news is good. A look at recent economic news shows this up:

The job growth is, at least currently, getting better month-by-month; the trend since a year ago is for more jobs created every month, and if it continues, we’ll be seeing better and better job reports as time goes on.

Fox News, of course, was first out of the gate to paint all this as bad news. Amongst all the good news, they point to the unemployment rate standing still for a single month, and claim that “unemployment is not likely to fall much further and may rise again.”

There’s a reason why they are always pointing out unemployment in particular: talking points. The Republican strategy to deflect good economic news and to try to push the economy’s head underwater–which they have been trying to do since Obama took office–currently is focused on touting unemployment, primarily because it’s the easiest thing to make look bad. They start by ignoring the fact that unemployment rocketed from 4.8% to 8.2% (a 3.4% gain) in Bush’s last year in office, and instead make huge noises about how Obama unforgivably drove the unemployment rate up from 8.2% to 10%–despite that being a far lesser increase (1.8%) than under Bush. Forget the past, they argue; it’s no longer relevant.

They therefore come to the specious conclusion that Obama was responsible for unemployment going to 10%. It is completely false because, as I have pointed out several times before, the unemployment rate is a lagging indicator, meaning that it shows what happened three quarters–nine months–earlier. Meaning that the unemployment rate reflecting what Obama started doing the moment he walked into the Oval Office was not in January 2009, but in October 2009–meaning that the real rate when Obama started was 10%–at its peak.

That, of course, means that Bush drove it up from 4.8 to 10%–more than doubling unemployment–and that Obama, far from driving it up, stopped it cold and drove it back down to 8.3%, a decrease of almost two percent. That is the actual assessment of what happened.

Now, keep that in mind when you look at the above charts. Then consider Fox’s claim that a one-month stall means it will never go down again and may in fact rise–and let’s see if we can debunk that. If unemployment is a lagging indicator, that means we should look back nine months to see what was happening, and… whoa, look at that. About nine months ago, job growth stalled. Whaddaya know.

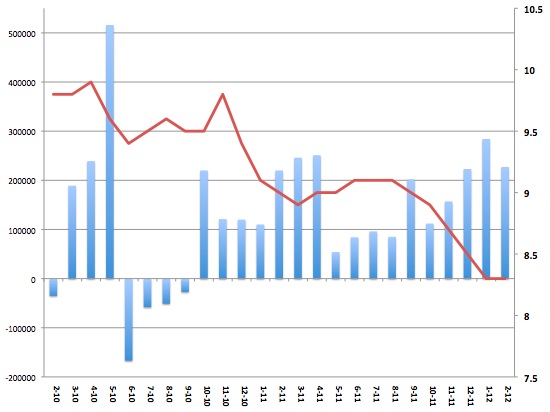

To test this, I got the job and unemployment data, and combined them into one chart. It came out thus:

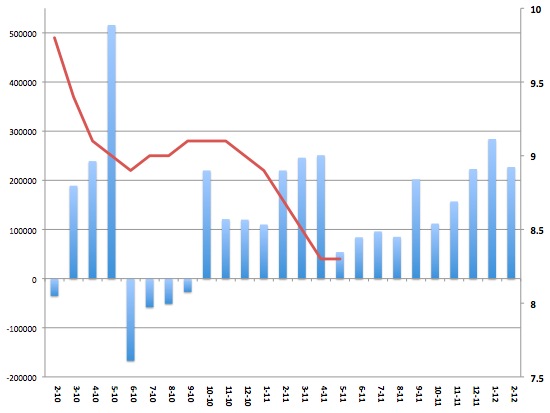

Doesn’t seem to line up, does it? But then, it hasn’t been adjusted to reflect reality–remember the nine-month lag? Look what happens when we move the unemployment data back nine months:

Well, look at that–the rate falls when jobs are added, and the rate rises when jobs are lost. The current stall reflects the fact that new jobs stalled nine months ago.

Who’da thunk?

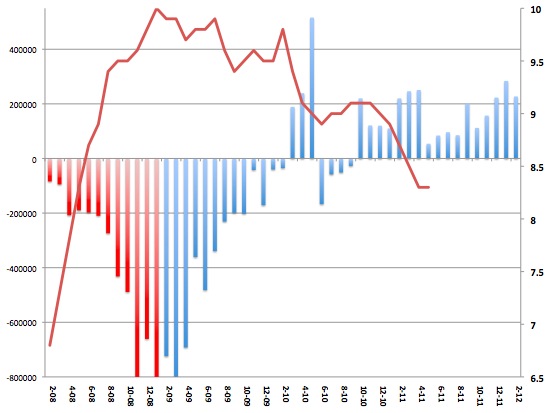

How does this work over the long run, though? Fairly well, as it turns out:

The bad news for Obama is that, for the next 4-6 months, unemployment will not be so hot–it may drop a point or two over the next 4-6 months (numbers might show a drop in June or July more than other months), but may not really start to change again until just before the election–which is the good news for Obama. The rate should start dropping regularly come September, when we see the numbers for August.

Based on nothing but a guess, I would say that the unemployment rate will probably be between 7.6% and 7.8% come November. The last three months, all good gainers, will show up in the unemployment rate in the three months leading up to election day. Not stellar, certainly the recovery is slow, but definitely pointing to a recovery. If Obama gets re-elected, then he’ll almost certainly surf the recovery back up, to the outrage of the right wing–who will find a way to claim it was all to their own credit. If Democrats are able to hang on to the Senate and get back the House, it’ll be a disaster for the Republicans, who will be in the back seat when the recovery starts gaining steam.

So, let’s see how I do against Fox News. Who do you think will be better at predicting the economic future–a major news network claiming expertise, or a nobody like me with zero Econ training?

Thing is, now we’re just halfway back to the worst of the 2001 recession:

http://i.imgur.com/leCEw.jpg

Plus we still have 8 million underemployed:

http://i.imgur.com/DubOI.jpg

AND we’re holding things together largely by massive – previously unthinkable, really — deficit spending of $1.2T per year.

Divided by $50,000 that should be 24 MILLION jobs being directly supported by this deficit spending, out of 132 million total jobs. That’s one out of 5 jobs being supported by BS — more probably, given the general multiplier that gov’t spending provides.

Ignoring the Fox News propaganda issue, your:

“who will be in the back seat when the recovery starts gaining steam.”

I don’t see a recovery in the cards, any more than Japan has earned a recovery from all its deficit spending, 1992-now.

The US economy is simply massively unbalanced. It’s really a 1% issue — the top 10% has taken the bulk of the productivity gains of the past 30 years, and in 2010 the top 1% took 93% of the income gain:

http://mattbruenig.com/2012/03/05/the-1-captured-93-of-income-gains-in-2010/

This is not sustainable! We used the housing bubble bullshit to keep the game going 2002-2006, but after that blew up we had to replace it with trillions of deficit spending.

Now, I could be totally off-base with my pessimism, but I don’t see why I am. The January trade deficit came in at over $50B:

http://www.nytimes.com/2012/03/10/business/economy/us-trade-deficit-widens.html

This, too, is unsustainable and is the core of our problem. This deficit is simply ripping billions out of the paycheck economy every month — the money we pay out of our paychecks for energy and manufactured stuff is not coming back to us as wages. This is a rather obvious imbalance when one thinks about it, yet you won’t find anyone in the press or even academics with an inkling of the actual mechanics of how this dynamic is working against us.