Mac Market Share

There’s a story hitting the news wires: the Mac has hit an all-time high of 7.95% market share, more than ever before, with the impression being of an immediate upward trend for Apple. Last year at about this time, some clueless tech writer at Computerworld wrote that the Mac OS was flailing while Vista showed robust growth, using the exact same source of stats that the new story uses (Net Applications’ tracking data). I wrote a blog post explaining in detail why this guy was full of it. Both stories–the one that was negative about Macs last year and the one which is positive about Macs this year–are wrong, and for similar reasons.

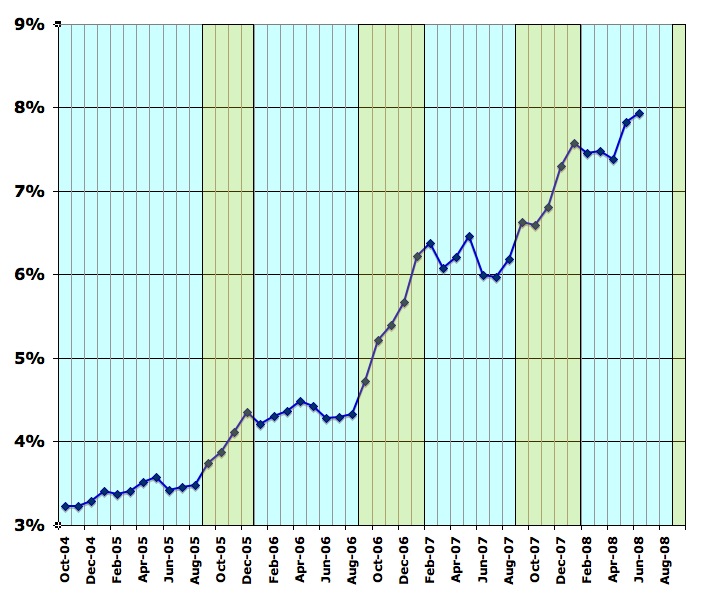

Yes, a new all-time high about Mac use is nice to hear, but not impressive to me right now. The reason: it’s not Mac season yet. I have noticed a pattern over the past three years–here’s the data over that period of time:

The areas filled in with green show sustained growth. See a pattern? Every year, starting in September, there is a sustained growth burst that continues until January. Between February and August, there are minor fluctuations, but the market share generally remains static.

The growth spurts are dramatic–less than 1% growth in terms of total market share in late ’05 (but that was bigger in terms of percentage of growth over the existing brand market share), 2% in late ’06, and close to 1.5% in late ’07. But right now we’re in the lull period.

Not to mention that the larger rise took place in May, not June (which was only a slight uptick from May), which was not really reported on. And if you look back, for some reason, there has always been a peak around April or May, so this is not a surprise. The safe bet is that the number will fall again in July and/or August, but then take off again in September, as always–probably representing back-to-school sales which create the growth spurt which lasts into Christmas sales, dying out soon afterwards.

Now, I’ll be surprised if the numbers continue to grow before September; that would be unusual, and could signal a bigger-than-usual surge in the latter third of the year. But right now, it’s not clear how big that surge will be. Yes, the iPhone 3G is making waves, but the original iPhone was making even bigger waves a year ago. While the current spurt trend–only two data points long–shows a slowing increase (2% to 1.5%), that’s less a trend than it is just a couple of data points. The surge this year could be anywhere from a 1% increase up to about 9%, or a 2% increase again up to 10%.

The only thing I’m pretty sure of is that there will be a surge–that’s the safe bet. And if you take a look at Apple stock, you’ll see a similar trend: a general pattern of big increases in the latter half of the year, with slower growth, decreases, and/or volatility in the first half.

That graph is less clear-cut, but you’ll notice that the biggest increases, especially when you discount the drop-and-recover beginning of 2008, always fall in the second half of the year, peaking over the new year, and then dropping or at least slowing. But since 2003, there’s never been a value drop between June and December.

Those seem pretty clearly to be the golden months for Apple.

The current stock price takes into account the past sales record, so I don’t believe the data in your post indicates that Apple’s stock is going to go up in the future.

http://en.wikipedia.org/wiki/Efficient_market_theory