The Obama Stimulus Plan

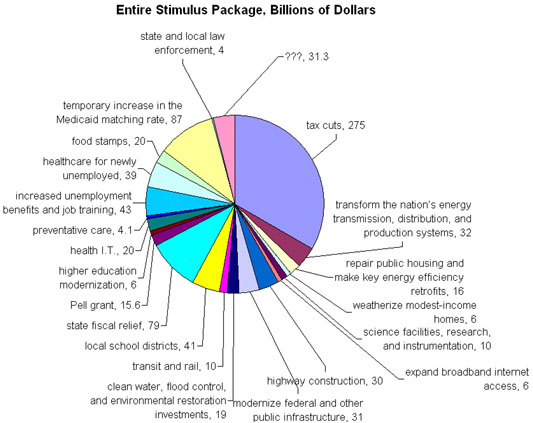

You’ve probably heard a lot about the stimulus plan, but what you have probably not seen is exactly where the money is going. So many reports in the news and on blogs mention major elements of the plan, general categories and notable expenditures–but you probably have not seen a dollar-by-dollar breakdown of everything in the plan as proposed by Obama (before the Congress leaves its mark). After searching, I found a great report in the New York Times that gave the details I was looking for. Below is the NYT’s Catherine Rempel’s pie-chart breakdown. The pink “???” slice represents money that was not listed in the summary she reviewed (presumably a large number of programs not specified in the report?).

You can also follow this link to a PDF (or better, right-click to download) for the House Committee on Appropriations’ 13-page report detailing each segment of the plan and how much it will cost.

The plan includes $275 billion in tax cuts, maybe Obama’s proposed middle-class tax cuts we heard about earlier (PDF report on Obama’s proposal alongside McCain’s). Possibly not, though–I am not sure if this is the first step towards achieving that, or if it is something completely different–perhaps this is a one-year measure as opposed to a permanent change. Republicans are suddenly proposing a middle-class tax plan which, on the surface, is even bigger than Obama’s. We can confidently read this as hypocritical pre-midterm-election posturing–the GOP never forwarded this kind of a middle-class tax cut before. It is probably nothing more than congressional Republicans forwarding a plan they know will never pass but they can later claim, “we tried to pass bigger tax cuts for you, but the damn Democrats nixed it!”

In any case, the other major elements of Obama’s plan, sorted by cost, are:

- $87 billion for a temporary increase in the Medicaid matching rate;

- $79 billion in state fiscal relief to prevent cutbacks to key services, including $39 billion to local school districts and public colleges and universities distributed through existing state and federal formulas, $15 billion to states as bonus grants as a reward for meeting key performance measures, and $25 billion to states for other high priority needs such as public safety and other critical services, which may include education;

- $43 billion for increased unemployment benefits and job training;

- $41 billion to local school districts through Title I ($13 billion), IDEA ($13 billion), a new School Modernization and Repair Program ($14 billion), and the Education Technology program ($1 billion);

- $39 billion to support those who lose their jobs by helping them to pay the cost of keeping their employer provided healthcare under COBRA and providing short-term options to be covered by Medicaid;

- $32 billion to transform the nation’s energy transmission, distribution, and production systems by allowing for a smarter and better grid and focusing investment in renewable technology;

- $31 billion to modernize federal and other public infrastructure with investments that lead to long term energy cost savings;

- $30 billion for highway construction;

- $20 billion to increase the food stamp benefit by over 13% in order to help defray rising food costs;

- $20 billion for health information technology to prevent medical mistakes, provide better care to patients and introduce cost-saving efficiencies;

- $19 billion for clean water, flood control, and environmental restoration investments;

- $16 billion to repair public housing and make key energy efficiency retrofits;

- $15.6 billion to increase the Pell grant by $500;

- $10 billion for transit and rail to reduce traffic congestion and gas consumption;

- $10 billion for science facilities, research, and instrumentation;

- $6 billion to weatherize modest-income homes;

- $6 billion to expand broadband internet access so businesses in rural and other underserved areas can link up to the global economy;

- $6 billion for higher education modernization;

- $4.1 billion to provide for preventative care and to evaluate the most effective healthcare treatments;

- $4 billion for state and local law enforcement funding.

I have hardly done a thorough analysis, but a quick read of that list is pretty hard to argue with. Emphasis on middle-class tax cuts and local-level services are a direct reversal of Bush administration policies, and about time, too–I don’t see anything in there at all that is aimed at the nation’s wealthy, or at corporations specifically (the only corporate tax breaks I found are tied to job creation). You know that if this had come out of the Bush administration, it would have asked to give more upper-income and corporate tax cuts, repeal of the estate tax, and all other kinds of giveaways to the rich which would not benefit the nation one bit. Instead, here we have a plan which leaves us with a dramatically improved infrastructure: better schools, more affordable education, improved roads, bridges, & highways, energy grids, housing, Internet, law enforcement–in short, instead of coming out with richer rich people and corporate coffers overflowing even more than before, we instead come out with a better and more solid national infrastructure which will pay off many times over in the future. Hell, even without an economic crisis, this plan would be a good idea.

With the passing of this plan, Obama would live up to a large number of his campaign promises–about 500 of which are tracked on this web page. Once the plan is launched, you can track its progress and how the money is being spent on this page. Remember how the Bush administration had similar web pages to show how all the money was spent on the Iraq War and the bank bailout? Of course you don’t, because there was never any such accounting. Another sign of change–we will have transparency, a switch from the years where corrupt Republicans could shovel billions of taxpayer dollars into the pockets of huge corporations and then claim “national security” or “we’re just not interested in telling you” as reasons why we never got a straight accounting.

We’re hardly there yet, but we are starting on the way towards a far better, fairer, stronger, and more competitive America.

Much of this can be paid for with better IRS enforcement. (See this link from Cringley: http://www.cringely.com/2009/01/how-to-end-the-recession/ )

Obama can gain revenues without raising taxes, and almost all of it coming from the ‘supply-side’ rich. If he needs more, he can raise more taxes on them later on, and I hope he will – to pay for healthcare reform, shoring up social security, etc…

I’d like to see transporation infrastructure quadrupled – because that’s a great way of reducing the disbursements one energy to the Middle East and emissions into the atmosphere.

Not a bad plan. But I wish it were double the size. Bush pushed roughly $10 trillion from the ‘demand-side’ of the economy to the ‘supply-side’ of the economy. That’s on top of 30 years of supply-side economics that has funneled all the gains in GNP over the last 30 years, that’s trillions of dollars, year in and year out, over to ‘supply-side’ rich which created the inbalance that has hollowed out demand and thus is the root cause of the current economic melt down (long term, wage growth has to keep up with increases in GNP across the board).

In my mind, Bush’s ten trillion dollar giveaway to the ‘supply-side rich’ was extremely audacious in its size. Any stimulus plan less than a trillion dollars isn’t serious.

In regard to Obama’s plan, I caught the hope. Now, I’m waiting on the audacity.

The more audacious, the better.

Obama administration needs to realize that in several months economic crisis and soaring deficit will be solely his administration’s and his party’s problem, so for any previous or future mistakes he’ll have to take the blame. Two-three months from now nobody will remember Bush’s policies and the Democrats have to be more careful on the long-term effects of massive spending. If the new stimulus fails, just like the past one, then this will balloon into Obama’s first political problem. We have to also realize, that on the long-term we won’t be able to afford more bailouts and there has to be alternative solutions, since we are passing the trillion Dollar deficit boundary. Printing more money can be utilized as short-term tool, but on the long run it will devastate economy. Something needs to be done immediately, but more regulation & spending does not seem to be a logical answer, we need another alternative solution. Maybe we should take pure libertarian approach and let the free market decide who wins or loses? This will cause social unrest and chaos, so as a society we can not afford this option either. Maybe we’ve killed the goose that laid eggs for us?