Those who advocate trickle-down, tax cuts for the wealthy, are dead wrong. The amazing thing is, it’s not very hard to work out why—but people seldom do the math. Let’s take a look.

Those who advocate trickle-down, tax cuts for the wealthy, are dead wrong. The amazing thing is, it’s not very hard to work out why—but people seldom do the math. Let’s take a look.

The idea behind cutting taxes for the rich is that wealthy people will take that money and create jobs with it.

First of all, let’s deal with this “job creator” falsehood. Purchasing (mostly by the lower and middle class) is what creates jobs, not wealthy people or businesses. Businesses hire workers only when it is absolutely necessary, and never simply because they have disposable income. Businesses only hire people when demand exists to justify the expenditure. Otherwise, businesses work hard to destroy jobs, because profits must be maximized, and payroll is one of the greatest expenses to a business.

So these people and businesses are not “job creators.” Still, the claim is that their investments will drive businesses that will hire people. Is that true?

Mostly, no, and certainly not in essence. Just ask this: when wealthy people get more money, what happens?

The idea behind trickle-down is that they invest it. Investment drives businesses, businesses hire more people, people get more jobs, etc.

However, there’s a major error in the very first step of that assumed process: that wealthy people invest the money in businesses that hire people. That’s not a valid assumption, especially in a bad economy.

When wealthy people get money, they do not say, “Terrific! I can hire more workers now!” Instead, what they do is to ask, “what is the best way I can put this money to work to get me more money?” And in a slow economy, when demand is low, they do not invest in businesses that offer goods and services—the kind that hire people. Instead, they invest in things like real estate, commodities, foreign currency, or a variety of derivatives—none of which drive the creation of jobs. When they do invest in businesses, they want ones that maximize profits—usually at the cost of the worker, demanding that pay and benefits be minimized and that “productivity” (translation: making each worker do more work) be maximized. This is often accomplished by using cheap foreign labor.

So giving money to rich people in a slow economy will not result in that money circulating back into the part of the economy where you most need it. In fact, it’s the entirely wrong end of the economy to put money into. Wealthy people are driven by the desire to accumulate wealth. Giving them more wealth—their end objective—will not drive them to go faster. It’s like giving the horse the carrot at the start of a trip instead of at the end. In another way, it’s like putting gasoline into your tailpipe.

So let’s look at reversing the idea. Instead of cutting taxes for the wealthy, what if we raise taxes—let’s say, for a start, to 50% at the highest margin. Take the money made from that added tax, and the money that would have been used to give the rich a big tax break, and instead, give it to the lower and middle class, in the form of both tax breaks and infrastructure jobs.

First off, we get a lot of value simply from the infrastructure spending alone. The infrastructure in our country is in bad shape, and is essential to the economy—it’s money we have to spend anyway, and the payoff down the line is great.

Second, we get job creation right off the bat by actually hiring people. Conservatives claim that “government never creates jobs,” which is baloney—the government hiring people to build infrastructure is far closer to job creation than is giving tax cuts to rich people. However, technically, they are correct, as job creation (as I pointed out earlier) is driven by demand. However, the demand, in this case, is that we need infrastructure. Whatever you call it, jobs are being created here.

Third, and most importantly, you now have millions of lower- and middle-class Americans either with new jobs and/or with more disposable income from tax breaks. These people do not spend that money on derivatives or foreign currency. They may use some of that to pay down debt, but much more, they will buy stuff. That creates demand, and that drives the economy, creating more jobs.

But wait, you say: we taxed rich people too much! They won’t have enough money to invest in new businesses, or they will be so repelled by the higher taxes that they will (as many Randians such as Bill O’Reilly claim) feel that it just isn’t worth it to try to make money any more!

That’s nothing but nonsense. First of all, rich people will always have enough money to invest. That’s why we call them “rich people.” The tax is on new income, not capital wealth. If money is fed to the lower part of the economy and demand rises, then that demand becomes the best new investment. That is what will drive wealthy people to make investments which involve new or better jobs.

But what if a wealthy person’s capital is already tied up? They really could have used that tax cut to invest!

Baloney. Even if a business or a wealthy individual’s assets are all tied up, they are still assets. And you know who just loves to lend money to wealthy people and businesses with lots of assets in a demand-driven economy? Banks. The wealthy have no problem raising capital in such situations. Millions of people are buying a product, you’re a wealthy person with lots of assets, and you want to borrow money to build that product which is in high demand? Of course banks will lend you money.

But what about the second point? Bill O’Reilly said that if Obama were to raise the marginal tax rate to 50%, he would see that as too onerous, and would quit his cushy, estimated $20 million-a-year job, laying off “scores” of workers, because having a take-home of $10 million instead of $12 million (although in reality, no one pays the top marginal rate on all their income) is just too little for him to sit on his ass all day and pontificate to crowds of adoring fans. What a hard life he leads. No, he would rather fire dozens of people who depend on him rather than suffer with only $10 million a year.

But does O’Reilly have a point? After all, if you tax people at 100%, nobody will want to make money, not legally, at least. So isn’t it logical that there’s some kind of limit for most people, where they’ll quit working if they payoff isn’t good enough?

In a way, this is like asking if a starving man would refuse to eat if you took away half his food. How little food could you offer a starving man in order for him to turn his nose up at it? It would have to be a very small portion.

Most rich people work hard for money, not for an optimally proportional after-tax income. If they want lower taxes, it’s because they want more money, not all or nothing.

Not to mention that, for two or three decades in the mid-20th century, the highest marginal tax rates were at or above 90%. These produced the best economic times we can remember! And if you want to want to argue that it was the war economy, be careful—that economy consisted of the government taxing high and hiring millions of people!

In order to understand this better, let’s ask a basic question: why do rich people keep trying to make money? For most people, making money is for necessities and then luxuries. But we’re talking about people with enough money that they could live in luxury for their entire lives without ever having to work again. So, why do they keep working for money? Or, at least, why do they invest?

I see only four reasons:

- They want to win. They want to be the best at whatever competition they are engaged in.

- They want to accomplish something. It might be a cause, it might be a beautiful product, it might be simply to be great at something.

- They love money. They would work no matter what the conditions to just make more money.

- They have a financial goal. Reach that amount of money, and then I’m out.

If you can think of any other reason that does not fall under any of these categories, let me know. However, that’s it as far as I can see it.

And now that we have defined these categories, ask yourself: will higher tax rates make ANY of these people quit and go home? Will any of these people just stop investing, even in a high-demand economy?

Of course not. None of them would. Let’s look at each type.

For the type that want to win, the tax rate is largely irrelevant, so long as everyone is taxed the same. They want to be the top dog. Taxing wealthy people more won’t change that, and so will have no effect.

The type that wants to accomplish something will similarly not be deterred by higher tax rates. They will still want to accomplish something. If the higher taxes make that more difficult, then they will work harder to do what they set out to do.

The type that just love money would not love it any less if they were taxed. They want more money, so if you tax them more, they will only work harder to make more, not less.

Finally, the type that have a financial goal will have to work harder in order to reach that goal. Some may be satisfied with a lower goal, but few if any would work less for it.

See the point? Higher taxes on rich people will not impoverish them, it will not make investment capital inaccessible, and it will not deter them from working hard—if anything, the rich will work more if you tax them more. If there is some go-home cut-off level, we know from experience that it comes at a marginal tax rate higher than 90%!

Not to mention two other underlying flaws in the Ayn Rand theory of “the productive class will leave the game” theory.

First, one assumes that the rich people are the productive ones. Wrong. They’re the ones who hire the productive ones. And there is no end to the number of people who want to play the business game. Every time there’s a void in the game, hundreds of others fight savagely to fill that void. There is no shortage of people to fill the ranks of business leaders to manage the many productive workers who will make the managers rich.

Second, the whole idea that rich people will stop working if taxes are even slightly higher must assume that wealthy people are weak quitters who can’t handle adversity. Do you really think that people who are driven to succeed for whatever reason are defined by their immediate propensity to give up the moment they encounter a setback?

That, like every aspect of the “don’t tax the rich” argument, is patently absurd.

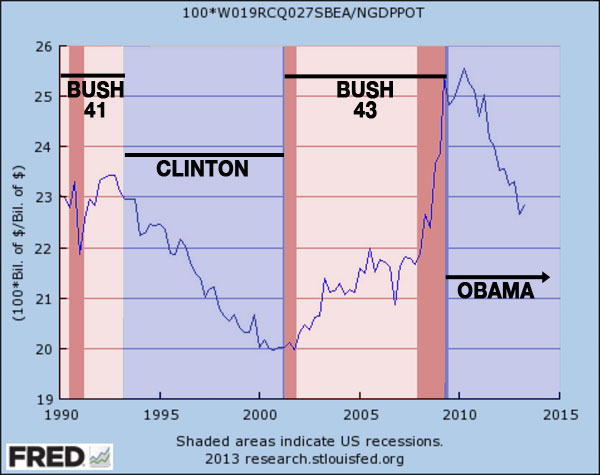

Taxing rich people will only improve the economy. When we did that more, the economy was better. Since we tax rich people less, the economy has degraded and sunk, while debt has soared. Hard to argue with facts.

I have written before about how conservatives make rookie “mistakes” in economics when it serves their purposes. They claim that Reagan doubled revenues but “neglected” to take inflation into account; they claim Obama drove unemployment up to 10% but “forget” that unemployment is a lagging indicator; they claim minimum wage hikes caused job losses in 2008, but “overlook” the subprime mortgage crisis.

I have written before about how conservatives make rookie “mistakes” in economics when it serves their purposes. They claim that Reagan doubled revenues but “neglected” to take inflation into account; they claim Obama drove unemployment up to 10% but “forget” that unemployment is a lagging indicator; they claim minimum wage hikes caused job losses in 2008, but “overlook” the subprime mortgage crisis.

Those who advocate trickle-down, tax cuts for the wealthy, are dead wrong. The amazing thing is, it’s not very hard to work out why—but people seldom do the math. Let’s take a look.

Those who advocate trickle-down, tax cuts for the wealthy, are dead wrong. The amazing thing is, it’s not very hard to work out why—but people seldom do the math. Let’s take a look. The first thing we need to realize about immigration is that any problem which exists does not lie with the people who come to this country without documentation.

The first thing we need to realize about immigration is that any problem which exists does not lie with the people who come to this country without documentation.