To hear Republicans talk about it, Obama has done nothing about the economy, has not created any jobs, has busted the budget with unprecedented spending, and is responsible for the unemployment rate being what it is. The stimulus, they maintain, is a failure, and the people are suffering because of Obama’s inaction.

The problem with these accusations is that they are all one-hundred-percent, Grade-A horse shit. Bush wrecked the economy, and Obama and the Democrats, despite massive Republican obstructionism, have managed to pull off a minor miracle. And here are the numbers to prove it.

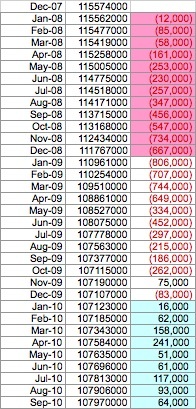

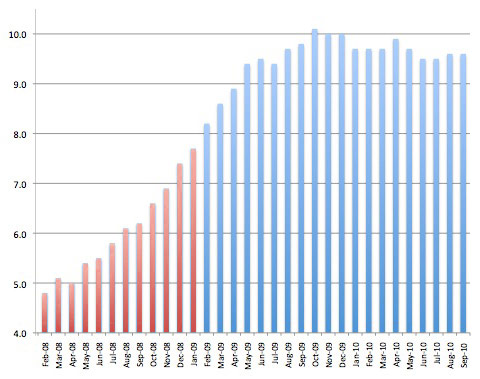

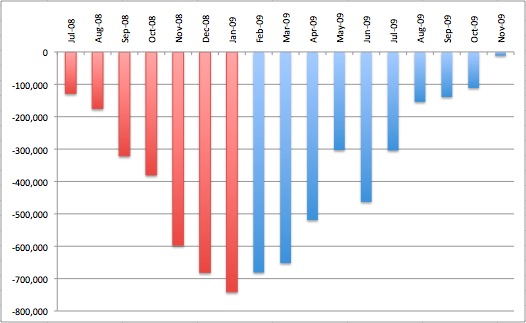

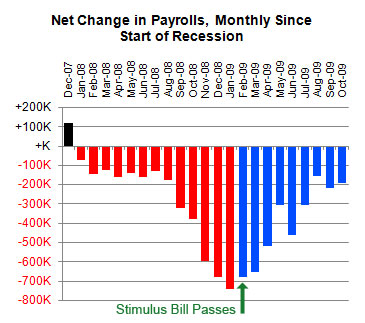

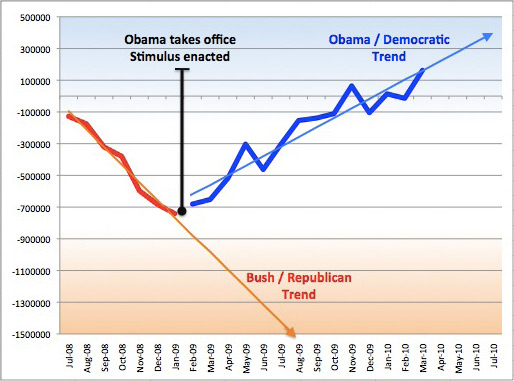

Before on this blog, I have refuted the claim about the stimulus’ failure; the numbers speak volumes–here’s a chart I published six months back:

With no other notable effect acting on jobs other than the stimulus, it would take huge leaps of legerdemain to explain the turnaround seen here in any other way than to recognize the stimulus as successful. As a result, Republicans simply ignore it, acting as if pulling the country out of a deep hole–their deep hole–is meaningless because the Democrats haven’t made the economy rocket into the sky yet. And sadly, Democrats–who should be plastering this chart up everywhere in sight–are letting their best advertising slip away as the conservative narrative takes hold.

Yes, the surge in jobs and/or the halt in layoffs sputtered soon after I made this chart, and since then the numbers have hovered below zero. However, this is pretty much what was predicted back in early 2009 by those who said the stimulus, as finally passed, wasn’t enough–they were 100% spot-on correct–and let’s not ignore the fact that we are substantially better off now than we were when Bush left office.

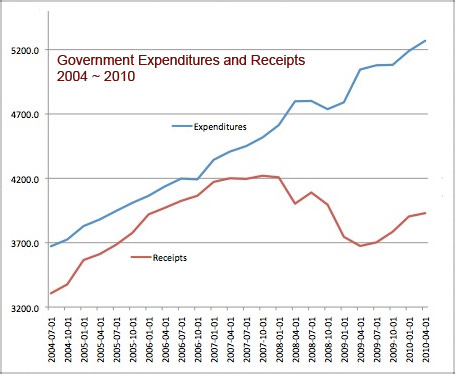

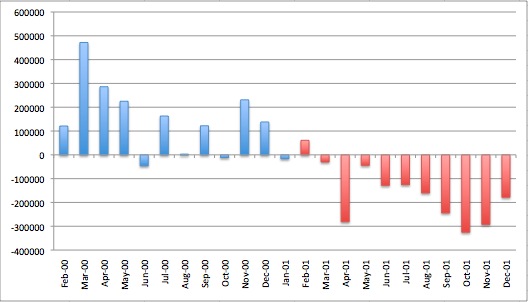

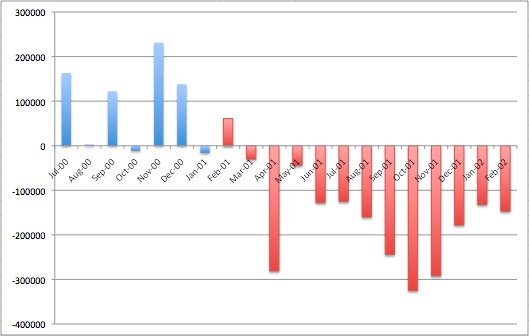

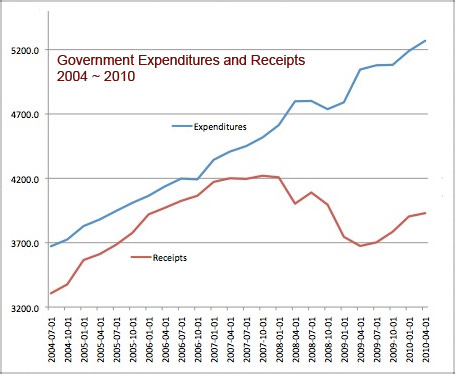

Now, how about the budget? That’s another GOP talking point–that things were going OK under Bush, at least tolerably well–but then Obama came in an exploded spending and the deficit. Let’s explode that lie, shall we? Here’s a chart [source data] showing expenditures and receipts over the past six years:

Ouch. Sure enough, deficits have exploded, and spending is up. Yes, spending is more of a straight line, but it’s not supported by revenue. Looks like under Bush, the deficit was under control, and then recently, under Obama, things have gotten out of hand.

Until, of course, you draw a precise line showing when Bush left and Obama took over:

What do you know. The deficit exploded under Bush, not Obama; Obama has been holding relatively steady. His spending is increasing at about the same rate it was under Bush. Also notice that the deficit is not that much greater now than it was when Obama took over–the arrows show the deficit when the transition occurred, laid over the latest numbers and a year before Bush left office. Obama, it turns out, has not really added much at all relative to what he was given. In contrast, Bush more than doubled the deficit in his last year in office.

So much for the “Obama and the Democrats have wrecked the budget” lie. Not to mention that soon after Obama came in to office and deployed the stimulus, the recession ended and government receipts started trending upward again. How about that.

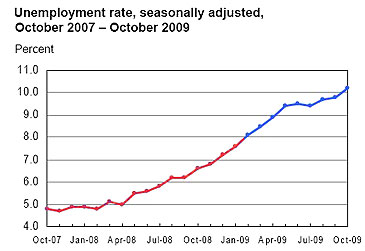

Another tack taken by the Republicans is the unemployment rate; their claim is that since the stimulus did not take the rate down to the optimistic projections of the Obama administration, Obama therefore owns the unemployment rate–he is, they say, responsible for it.

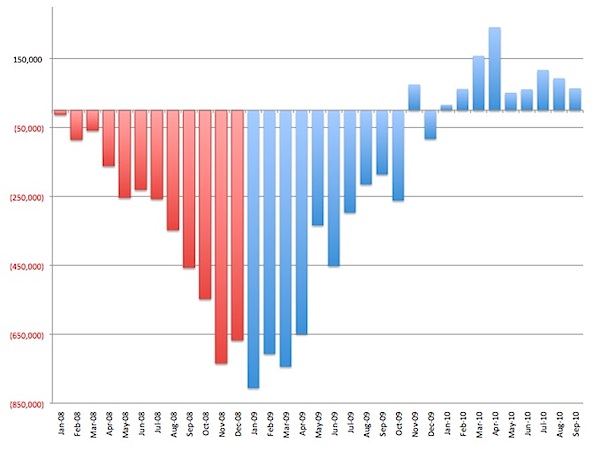

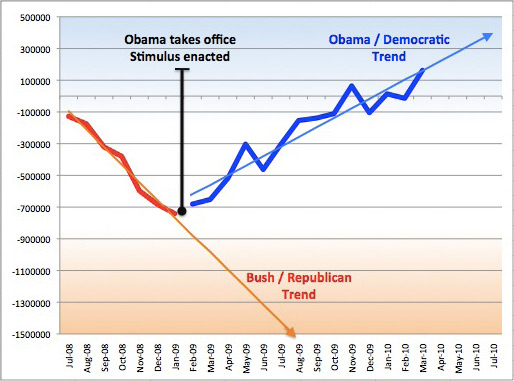

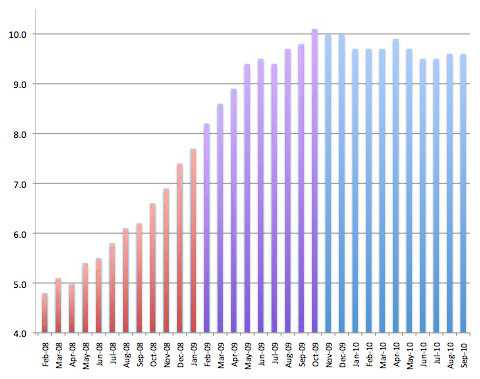

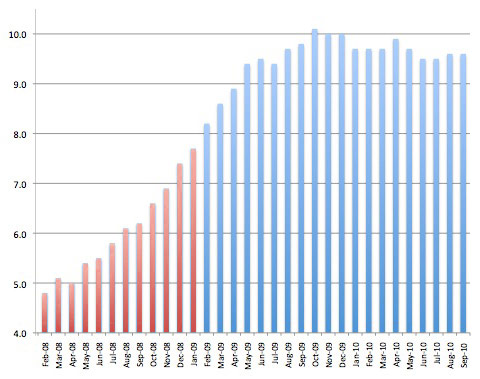

But let’s take a look at that chart over time as well–red represents Bush months, blue for Obama:

Despite the fact that the trend and momentum started and gained steam fully under Bush, it doesn’t look too great for Obama here–when he came in, the rate was just under 8%, then it went up to 10%, and now is hovering between 9% and 10%. Republicans have picked up on this, adding fuel to their criticisms.

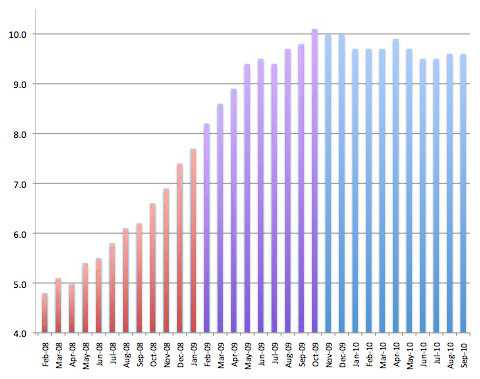

One problem: the unemployment rate lags behind improvements in the economy, usually by about three quarters. Apply that to the chart, and you get this:

Seen this way, one finds that not only was Obama not responsible for the 10%, he has actually lowered unemployment since he got into office. This would not be a surprise to anyone aware of the job trends since the stimulus began. Of course, this doesn’t make things all rosy–we’re still in a bad place, and slightly better than catastrophic is still terrible.

However, that’s why the unemployment rate seemed to go the opposite direction of the job surge: not only were we delayed by nine months or so, but in addition to that, we spent a year in negative territory–despite the fact that things were getting way, way better, we were still losing jobs up until late ’09. Thus the reversal in unemployment trends has been tepid so far.

So, let’s pause for a quick review: Conservatives say the stimulus is a failure. The facts say it was a resounding success, reversing the horrific nosedive that Bush had put us in. Conservatives say that Obama exploded spending and destroyed the budget. The facts show that Bush did all of that, and under Obama, spending has increased at the same general rate it did under Bush, but deficit increases have slowed greatly. Conservatives say that Obama made unemployment rise to 10% and hasn’t done a thing to change that. The facts say that Bush drove unemployment up, and that Obama stopped the trend and has slowly been wrestling the number down.

The difference is like night and day–Bush wrecked the economy, Obama has been bringing it back under control. And now Republicans are trying to blame the guy who has been helping for all the damage that Republicans wrought on the economy.

OK, back to the unemployment numbers, and where they will go. Now, the stimulus surge came to an end after May, the month in which we gained about 430,000 jobs. There was a 4-month period from February to May when the surge continued upwards, and then things went dead from June, since which time we’ve lost roughly 100,000 jobs a month.

If unemployment lags as predicted, this will be bad timing for the Democrats, and very good for Republicans: if they win the House in November, it will probably be to news that unemployment is dipping, a trend that should continue until early 2011. They would, of course, attempt to take full credit for the change, acting as if it were the euphoria over their election wins and the expectation that they would pass tax cuts for the wealthy that spurred the gains–despite the fact that it would be the tail end of the stimulus and the special employment due to the census. Even more ironically, the trend would have continued far upwards and might even have taken us out of our dire economic straits had not the Republicans cut the stimulus down to well below what it should have been.

Nor would I be surprised if (a) the downturn in unemployment ends somewhere around February or March 2011, and (b) Republicans attempt to blame it on the Democrats for not going along with all the crap they will try to ram through the House the moment they have the gavel.

I don’t have a sterling reputation for political and economic prognostication, though, so let’s see how this plays out. In the meantime, it looks like Americans are blaming the bad economy on those who have done a good job repairing it so far, and are set to hand over power to the party that caused the worst of it and has hampered the recovery. You get what you deserve. Too bad about all the people who you’re dragging down with you.